When your business is starting out, you need to do everything in your power to give it a fighting chance for survival in a competitive small business market. Part of this process is having a clear understanding of all of the costs that are incurred – both during the initial set-up process and ongoing.

What are the main operating expenses for small businesses?

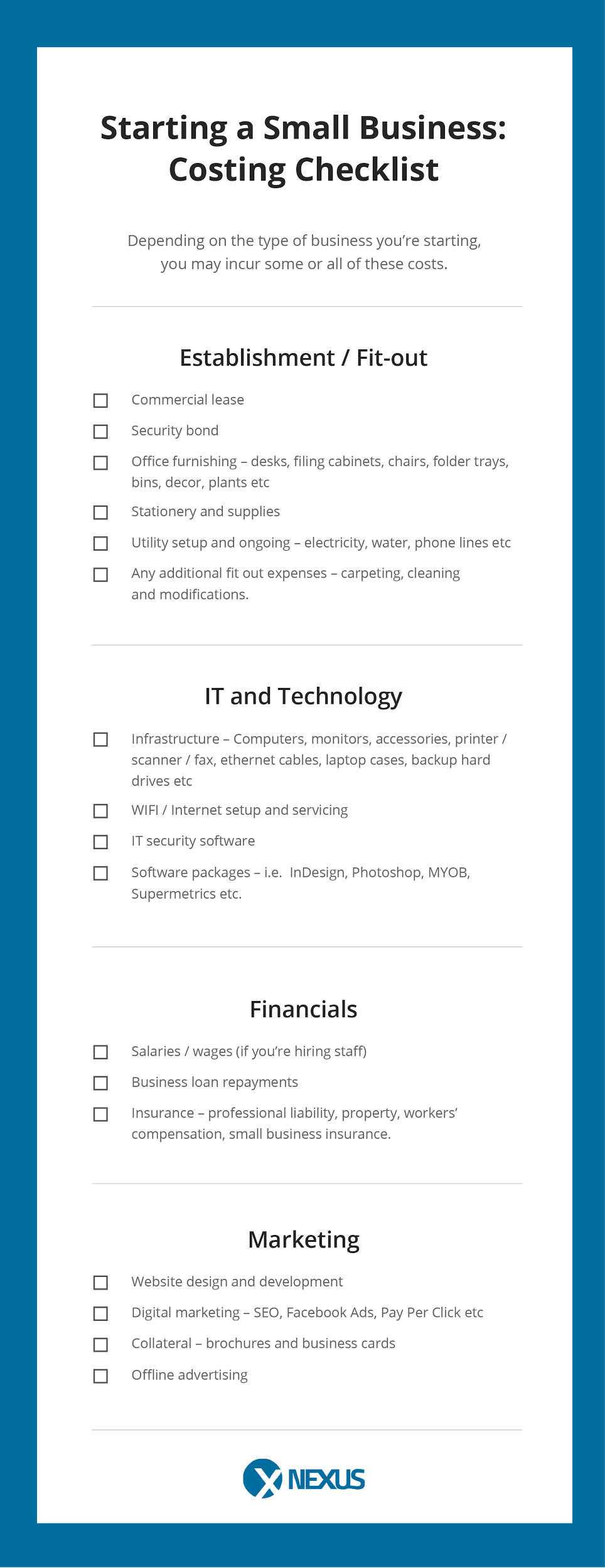

Below are some common setup and operational costs that most small businesses will incur.

Of course, all of these costs need to be managed effectively if you want your business to break even and become profitable.

How to manage small business costs

A handy way to manage the expenses your business incurs is to divide them into two groups – one-off costs and ongoing expenditures. This means you can more easily estimate what your expenses are going to be later in the year, avoiding any dreaded surprises.

One-off costs are those initial outlay costs that are required to get the business ready to trade. These may include website build, fit-out and furnishing, and registration fees. Ongoing costs will include rent, marketing spend for the future, professional development services, salaries, and recurring spend on technology.

To manage these ongoing costs, a cash flow forecast is necessary. A cash flow forecast is a crucial tool for every business. The forecast will help you determine whether your business will have enough cash to run day-to-day business activities, as well as whether there’s opportunity to expand, upgrade premises, or hire new staff.

Costs associated with commercial leases

Commercial leases can be expensive and the running costs can be a drain on your profit. Never mind the fact that commercial leases can be a minefield to understand. While you may believe you have found the perfect location for your business, there are three key things to consider before signing a commercial lease.

1. Total occupancy cost

The total cost for that commercial lease may not actually cover everything. In fact, a lot of the total cost may actually be hidden. For example, does the rent cover the total occupancy costs which includes the landlord’s outgoings, such as tax, council rates and water rates?

It’s important to understand whether you’re entering a gross or net rental agreement so you can forecast your total occupancy costs, and predict how much the lease will cost you over the total period.

2. Increasing rates

Commercial leases will generally increase annually by a percentage, so if you’re committed to a five or ten-year lease, you need to build this increase into your projections. What’s key here is understanding the clause in the lease agreement – is it a fixed rate or is it CPI that varies? It’s important to forecast for annual rent increases in terms of cash flow and what you will need to outlay on rent each year.

3. Fixtures and set-up costs

Anytime you’re starting a new business in a space that’s new to you, you’ll need to fit it out to suit your needs. While there may be some partitions erected and a couple of office spaces available, are these right for you? Fitting out an office space to suit your business will be done at your expense.

There also may be a cost when your lease is up if you choose to move or are forced out for whatever reason. This is generally known as a ‘make-good clause’. It essentially ensures that you return the space to how you found it when you leave, which can end up being a large additional cost when the lease ends.

Save on commercial rent costs with our flexible office spaces on the Central Coast

Reduce operational costs by renting flexible office space

Setting up a new business is expensive, even before you factor in a commercial lease. That’s why it’s so crucial to do your research and due diligence. If you’re determined to find your own space, be sure to shop around. Don’t settle for the first space you see, no matter how incredible it is. Even seeking other options may give you some bargaining power if you do choose to go for your original choice.

Co-working spaces are an excellent alternative to commercial leases. Today’s office is mobile – with smart technology, the cloud and wifi, your office can move with you. Co-working spaces significantly minimise your overheads, and allow the flexibility for you to scale up or down as needed. So when starting out, do you really need – and can you afford – a dedicated office space?

Regardless of whether you choose to invest in an office or to find a co-working space that works for you, it’s crucial to weigh up all financial options – what’s going to be best for you and your business?